Pertinent questions about the type of bombs used in the 2002 Bali bombings which left over 190 dead are raised in this article by Jakarta Post Editor, investigative reporter and licensed P.I., Robert S. Finnegan. The forensic investigation was wrapped up in record time after only a week and a half.

Like Summer Tempests Came His Tears

O, Ratty!’ he cried. “I’ve been through such times since I saw you last, you can’t think! Such trials, such sufferings, and all so nobly borne! Then such escapes, such disguises such subterfuges, and all so cleverly planned and carried out! Been in prison–got out of it, of course! Been thrown into a canal– swam ashore! Stole a horse–sold him for a large sum of money! Humbugged everybody–made ’em all do exactly what I wanted! Oh, I AM a smart Toad, and no mistake! What do you think my last exploit was? Just hold on till I tell you—-“

The public deserve to know exactly what shares Santaro had on his register when Nutt, from Ratty’s department, told him to change them to investing to trading, what sales and purchases he actually did in the 12 months preceding December 06 and which were recorded on his register.

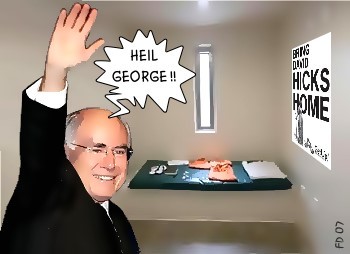

Howard’s dread locked holiday

Labor Party supporters will be grinning from ear to ear today. With

Labor Party supporters will be grinning from ear to ear today. With

- prime monsterial poll popularity plummeting,

- Santoro facing more serious allegations of impropriety over pork for a Brisbane property developer’s ten retirement villages, and

- loathsome shock jock Alan Jones in court for naming a juvenile on air,

the rodent’s electoral prospects have never looked bleaker. To top it off, there are accusations that David Hicks was sedated before being told of the last dodgy charges against him. Hick’s lawyer in the federal case against the Whorestralian gobblement is intimating the ratbag gang may be hauled into court.

The legal action, which is due to begin in May, argues that the Government breached its duty of care to Hicks by not demanding the US Government release him from Guantanamo Bay as other countries had done with their citizens.

Hicks’s lawyer, David McLeod, told the ABC that besides the Prime Minister, Attorney-General Philip Ruddock and Foreign Minister Alexander Downer could also be called to the witness box.

Mr McLeod said most of the evidence for the case would be agreed to without the need to call witnesses before the trial went ahead.

“If it can’t be agreed, then there will be a request for certain witnesses and it may well include Mr Downer and Mr Ruddock and indeed Mr Howard as potential witnesses,” Mr McLeod said.

To highlight his dire plight for the past five years, Amnesty International is exhibiting a reconstruction of Hicks’ Guantanamo cell at Martin Place in Sydney. People experiencing the conditions of Hicks’ inhumane incarceration have described their reactions as “traumatising”.

IT consultant Nikki Lee, 33, said it was a surreal experience stepping inside the replica cell, which includes a short bunk bed, a narrow window and a stainless steel toilet and wash basin.

“It’s very small and quite terrifying really to imagine spending that much time in there,” she said.

“It makes it more real and unreal at the same time because it doesn’t seem that this could happen to someone who has not committed a crime.”

Fitted with a security camera on which people can record their thoughts, the art vérité exhibition will soon tour to other states.

We’ll be leaving a strong message of disgust when the wardrobe-sized room visits Queensland. Wonder how many people have already expressed their wish for the ratbags to trade places with Hicks?

Pynes and Needles

Those who bleat loudest about a religio-political need to control other folks’ privates quite often seem to conceal hypocritical naughty and sometimes illegal self-indulgences. Consider the burgeoning congregation of disgraced loony TVangelists and shamed Catholic clergy of recent years.

Replete with hallmark reactionary political stances on law and order, indigenous rights and people’s bodies, particularly women’s bodies, Santoro and Pyne share a taste for the hysterical holy rolling vigilante vice squad.

TONY JONES: Chris Pyne, do you believe in God?

CHRISTOPHER PYNE, LIBERAL MEMBER FOR TRUST: I do, actually, fervently.

TONY JONES: So what do you think the view of God would be towards an apology, a formal apology towards Aboriginal Australians?

CHRISTOPHER PYNE: I think the first thing is that God is always on everyone’s side, Tony.

That’s why he’s been so popular for so long, so for anyone to suggest that God is not on a particular person’s side I think misses the point, and I’m surprised that a prolate of the church would have such a view.

It lends itself more to the political bear pit than it does to the pulpit.

TONY JONES: I think you might have missed the question, though.

I mean, the question was, if you do believe in God, do you think God would have a view about whether there should or should not be a formal apology to Aboriginal people?

CHRISTOPHER PYNE: No, I don’t think God would presume to mettle in the politics of Australia or any other country.

Notwithstanding that Pyne and other wowserish fundoids indulge in this sordid political ‘mettling’ constantly on the supposed behalf of the object of their worship, the oblivious Pyne brazenly exposes himself:

I have been praying to God every year for my re-election.

So far he’s rewarded me, so I am assuming he’s on my side, which must make him a Liberal.

Pyne, the ‘junior woodchuck’, has been enlisted by the rodent to investigate Santoro. Given their shared predilections and support base, we don’t expect anything less than the shameless whitewash predicted by Wayne Swan.

Outside noisy, inside empty – old Chinese proverb

Despite the extraordinarily generous largesse of the Whorestralian taxpayer subsidising her mature age Mandarin language lessons to the estimated tune of $70,000 (that’s RMB430,000), it appears our investment in Amandarin Vanstone has not borne fruit. The $70,000 could include

Despite the extraordinarily generous largesse of the Whorestralian taxpayer subsidising her mature age Mandarin language lessons to the estimated tune of $70,000 (that’s RMB430,000), it appears our investment in Amandarin Vanstone has not borne fruit. The $70,000 could include

… a $3,600 airfare to China for the Senator’s teacher.

New Immigration Minister Kevin Andrews is reported to be deeply concerned by the spending and has demanded an audit into the spending.

Mandarin lessons are cheaper in Shanghai

…where university courses cost around RMB8,000 to RMB12,000 per semester, or hourly lesson rates cost anywhere between RMB40 to RMB200. Even removed from a normal Chinese-speaking environment, you would think that spending that large amount of money allow you to obtain a reasonable degree of knowledge for the language, wouldn’t you? Not so.

Amanda’s viva exposition of her newly acquired skills ‘failed to impress a seasoned Mandarin-speaking businessman when delivering a speech in Mandarin in Canberra last year, with the man describing it as “excruciating”‘.

Kevvie Rudd speaks Mandarin fluently – was Amandarin jealously keen to catch up?

Or did she want to taunt immigrants or detainees in Australia’s immigration detention centres in their own language?

…

Further reading reveals that recently the overspending Senator may have been angling for a plum job representing Australia in China.

Perhaps we should direct our hard earned tax dollars into intelligence and skills aptitude testing for pollies before allowing them to pursue their wilful follies at our expense.